There are 3 tools that people can used to manage their particular private funds. They’re an individual life plan, a personal budget and an individual stability sheet. Whenever these tools are determined to folks most acknowledge a life program but don’t really get one. Most understand and you will need to have a budget…sort of. But, a phenomenal wide range of individuals do not have clue just what a stability sheet is. So here you will find the standard things you must know about a balance sheet.

The reason why should we have a balance sheet?

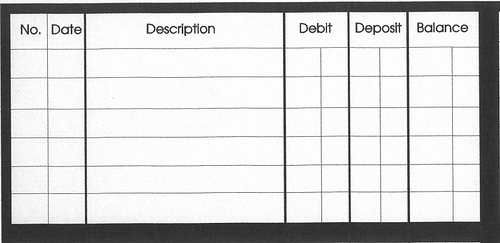

A balance sheet is where you retain track of exactly how much you have and how much you owe therefore the distinction between the two. You are taking the worth of the possessions (everything you own) and subtract the worth of your debts (what you owe) to get your net worth. You need to understand what your web worth has reached any given time. It is additionally essential to understand the price and construction of your assets and liabilities.

Your net worth should always be a good number. The older you are the larger the number should be. That is because you will need this net worth to invest in your pension when you can not any longer strive to offer income to your spending plan. The assets in your stability sheet fund your retirement in three ways. They keep expenses down. The best illustration of it is residence ownership. If you possess your own house you simply will perhaps not need to pay a home loan payment. This implies you need 30% less to live on each month. The next way that possessions fund your pension is you spend all of them in earnings making assets such as Certificates of Deposit, Bonds or dividend creating shares. A third way is you can sell off assets at a slow pace to finance your financial needs as you get older. A reverse mortgage is a great instance of this.

- Possessions and Liabilities

You need to know what an asset is and what a liability is. Additionally you must know that there are different types of assets and different kinds of liabilities.

A valuable resource is an item of price which you own. It has a market price this is certainly the amount that you can offer it for. The worth is just what the item would offer for if you had to sell it into the quick phrase that might be days or months with regards to the resource. When valuing your assets you must give consideration to this and be truthful about precisely just how a great deal your asset would sell for into the brief phrase. The complete price is written straight down given that asset on your own balance sheet. There could be an offsetting liability. For a home it could be the home loan or any other financial obligation secured resistant to the house. For a car or truck it would be an automobile loan. The difference between the worth of the house or car and what exactly is owed is the equity for the reason that certain investment. This might be like a web worth for that certain resource.

There are appreciating assets and depreciating assets. A residence is usually an appreciating asset over the extended term. In current occasions we have actually discovered that into the quick phrase a house can lose its value rather quickly. Nevertheless, many housing markets retrieve when you look at the lengthy term and a house should value with time. an automobile is nearly always a depreciating asset. That suggests that as it ages it becomes worth much less every year. Appreciating assets are far even more stability sheet friendly than depreciating assets.

Assets that can have a lien placed on there are the actual only real people that financial institutions or other lending establishments will give consideration to as good as resource entries on a balance sheet. Things such as furnishings and precious jewelry are perhaps not considered assets for usage in enabling a secured loan. Things for instance the unused part of a range of credit or credit card limitation are maybe not possessions on any style of stability sheet.

Debts are everything you owe. Any kind of financial obligation is a responsibility. There are many forms of financial obligation. There’s guaranteed financial obligation. This implies that the financial obligation is secured by a lien against a valuable resource that you own. The lien while the financial obligation should always be on the cheap as compared to resale price of the asset. Unsecured debt does maybe not have any such lien and is hopefully based on your ability to program the debt. The issue with unsecured financial obligation like credit cards is the fact that it’s really perhaps not offset by some asset that you own and acts just to decrease the web worth on the balance sheet.

Debts are everything you owe. Any kind of financial obligation is a responsibility. There are many forms of financial obligation. There’s guaranteed financial obligation. This implies that the financial obligation is secured by a lien against a valuable resource that you own. The lien while the financial obligation should always be on the cheap as compared to resale price of the asset. Unsecured debt does maybe not have any such lien and is hopefully based on your ability to program the debt. The issue with unsecured financial obligation like credit cards is the fact that it’s really perhaps not offset by some asset that you own and acts just to decrease the web worth on the balance sheet.

Credit debt would thus be categorized as bad debt as it just will act as a drag on building positive net worth. A home loan in which you pay the principal down a little every month as the property is increasing in price is good personal debt. That is since you add to your net worth in 2 means; first you pay off the debt and also the next way is the fact that the asset that secures the mortgage (your residence) increases in value while you pay off the mortgage. Both deliver increased value to your web worth.

- Balance sheet goals

There is only one goal which you need to focus on for your stability sheet. You will need to possess even more than you owe. The regular pattern is the fact that the older you receive the larger your net worth becomes. There are two basic dynamics that contribute to this trend. One is the wonder of compound interest. The longer that possessions are permitted to compound in cost savings and expense items, the bigger the annual share is to your private net worth. This might be certainly particularly real when it comes to 2nd fundamental dynamic. The biggest portion of many people’s web well worth is the ownership of the residence. As you spend straight down your mortgage, the later payments pay a greater percentage resistant to the principal much less on interest. It is an as a type of reverse compounding. You pay much less interest. In addition the compounded increases of property values are really large whenever you place all of them in viewpoint of everything you might have compensated for the house 20 or 30 many years previously. Some many years they may get up just as much as you paid for the residence when you purchased it.

Conclusion

For the normal person this article is a great beginning on which you need to understand about a personal balance sheet. While you work with your private stability sheet you certainly will learn more and much more about financial products and just how to utilize them to improve your net worth. Your web worth is the ultimate bottom line. If a financial item does not deliver positive leads to your net worth after that you should seem for another item.