Desire to make some cost savings but do not see it happening? Well, you’re not truly the actual only real one, many individuals which you see near you experience similar financial problems together with good explanation why we say it is basically because I had already been dealing with exactly the exact same problem considering that the time I started operating.

I understand it is very upsetting to see no cost savings after having slogged for a long time or months within my case. As soon as it begins to get difficult, you begin cribbing about your job and income. Allow me to ask you to answer a question; will it be your work and wage or your extravagant life that keeps you from generating some cost savings?

The Importance of Planning a Private Budget

Actually analyze your position and you will discover that it is not your earnings but your badly handled finances that does not enable you to conserve. Needless to say, there is various other explanations since well but it is usually the instance. But no matter what instance can be, if you plan your spending plan realistically you may be many likely to see a considerable cut down in your expenditures.

Planning an appropriate spending plan is the key to generate income. Be it huge companies or functioning individuals, both want to have a spending plan that they have to follow to be able to see their particular funds grow. After you have worked on a proper financial plan, you understand you may be on your way in order to make some considerable savings and discover your money developing in your banking account.

Budgeting Methods That Protect You Money

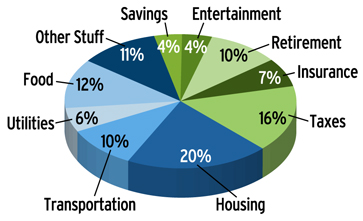

Have you ever realized that in one day we do a good deal of impulsive expenditures? These impulsive expenditures or unneeded spending can be averted. But for that, you should understand where your cash goes. To be able to do that and then make a personal spending plan you will have to hold a track of this followings:

- Keep a check on your expenditures: this will be the many inexpensive method to reduce straight down your spending. Utilize a notebook and keep establishing your investing or record them on MS Excel sheet and after that assess your expenses, figure out where is it possible to reduce straight down and work on them appropriately.

- Figure out your needed expenses: before starting spending your money, make a spending plan for which you have to make sure that all your valuable requirements are looked after of and just how much cash you are remaining with. From the left over cash you again have to discover just how much you’ll want to save along with all the remainder you are able to enjoy.

- Continual expenditures: these are the expenditures which you require to make on a monthly basis like various insurance coverage payments, childcare, school product launches, trash services, movies, dinners, etc. these

Businessman working on tablet computer – producing charts and reports expenses are a must and can not be reduced. So estimate all of them and discover just how much you ought to spend more or less.

- Adjustable expenditures: these expenditures are maybe not on a month-to-month foundation like Christmas time, birthdays, father’s day, mother’s time, etc.

- Financial loans: knowledge financial loans, credit card debts etc.

Today in order to make a personal spending plan, all your valuable expenses have to be on a monthly foundation. When you add up all your expenses and next divide them by 12, what you get is really what your normal monthly expenditure is expected to be.

My Private Budgeting Experience

Once I was going crazy with my expenditures and I didn’t know what to accomplish, my pal told me to follow the thing I only talked about in the preceding paragraphs and think me, we became happily astonished to begin to start to see the outcome. we nonetheless have actually a similar work utilizing the exact same wage yet it feels a lot different.